Hypercom to acquire Thales SA eTransaction Business

Hypercom Corp., a payment technology company, plans to acquire Thales SA's e-transactions business line. It also has obtained a $60-million financing commitment from Francisco Partners. The proposed business combination would represent the third largest global provider of electronic payment solutions and services. The e-Transactions activities of Thales is focused on high security electronic transaction solutions and is complementary in many ways, providing additional revenue with cost and technology synergies which Hypercom believes is a financially and operationally compelling combination.

Just as the convenience of online banking and payments was a major driver in turning the internet into a mainstream transaction channel, so will convenience drive the deployment of unattended transactions. In today's world of disparate working hours and busy private lives, consumers increasingly require products and services that are available.

Announcement Date: December 20, 2007

Deal Value: $120 million (cash plus potential earnout of $30 million)

Intuit to acquire Electronic Clearing House Inc.

Key driver and stakeholder for a cost reduction effort leading to savings of more than $8 million annually. Thales e-Transactions. 2003 – 2004 1 year. Toronto, Canada Area Partner, Director of Global Recruiting at McKinsey & Company Management Consulting Education University of Cambridge 1993 — 1994 LL.M., Law University of Oxford 1989 — 1991 B.A. Juris, Law University of Saskatchewan 1987 — 1989 LL.B., Law Carleton University 1983 — 1987 B.P.A., Public Administration Experience McKinsey and Company October 2008. Test VID/PID (See below) 0x03EB. Mouse Demo Application. Keyboard Demo Application. Thales e-Transactions, Inc. May 2004 – Aug 2004 4 months Worked as part of 6 member team to port individual POS applications onto new Multi-Application Framework environment on a 32 bit Arm7.

Intuit Inc. is acquiring Electronic Clearing House Inc., provider of electronic payment processing solutions, including check, debit card and credit card processing, as well as check verification, collection guarantee services, and automated clearing house capabilities, or ACH. Intuit had previously signed a definitive agreement to acquire ECHO in December 2006, but the parties mutually terminated the arrangement in March. Since that time, ECHO has refocused its business and addressed governmental concerns while continuing to generate revenue growth. Intuit expects ECHOs technology and operational assets will help it accelerate growth and strengthen its expanding small business ecosystem that includes the fast-growing payments space. In addition, the acquisition of ECHO will expand Intuits sales and distribution channels and provide relationships with thousands of customers, including larger enterprise customers.

Announcement Date: December 19, 2007

Deal Value: $131 million (cash)

Seller Revenue $76.9 million (ttm)

Clear2Pay NV has acquired Diagram EDI

Clear2Pay NV (Belgium), a provider of payment solutions for financial institutions, has acquired Diagram EDI, a French provider of e-banking and online payment solutions. Clear2Pay has raised around $40 million in VC funding since 2001, from firms like Big Bang Ventures, Intel Capital, GIMV, Quest Management, Iris Capital, AGF Private Equity and TrustCapital Partners. Diagram has been engaged in the electronic banking field currently providing a range of end-to-end Internet banking solutions for both retail and corporate banking environments. Through its offices in France, Algeria and Egypt and a network of partners and affiliates the company has implemented projects in over 50 countries. Clear2Pays core strategy is offering an end-to-end payments transaction environment. This means that it starts at the very first point of customer interaction, often the Internet banking application. The Diagram product suite complements its Netbank product, and the functionality of both will be integrated in its Open Payment Framework environment.

Announcement Date: December 6, 2007

Deal Value: Undisclosed

Peak Performance acquires Eifer Technologies

Peak Performance Solutions, Inc. has acquired Eifer Technologies Pvt. Ltd., an insurance technology company which offers insurance application support & services, custom development, project management, business processing outsourcing, and information technology outsourcing. Peaks acquisition of ETP represents the latest move in Peaks strategy of connecting customers with innovative solutions that deliver measurable and significant ROI. Plans are to have ETPs personnel, who are experienced with property & casualty insurance applications, augment Peaks U.S.-based staff to provide ongoing support for Peaks suite of software products, and to provide development services for Peak, and other organizations in North America, India, China and the UK.

Announcement Date: December 3, 2007

Deal Value: Undisclosed

Purepay acquires CybrCollect

Purepay, a buyout fund focused on payments, banking and the financial supply chain, has acquired CybrCollect, an electronic check recovery provider. The company has more than 20,000 customers and a broad network of sales agents across North America. For Purepay, this is the third acquisition in recent months. The electronic check recovery market is highly fragmented with many players focused in specific geographies. Purepay believes an industry consolidation led by a national player will result in strong economies of scale, benefiting both merchants and the industry. Purepays acquisition of two of the leading mid-market remittance providers, Creditron and Netvantage, creates a real cross sell opportunity for CybrCollects check recovery and electronic payment products to Purepays strong mid-market customer base.

Announcement Date: December 3, 2007

Deal Value: Undisclosed

Edentify to acquire Orbis Systems, Inc. and ViewTrade Securities, Inc.

Edentify, Inc., a provider of identity management and fraud detection solutions, is acquiring Orbis Systems, Inc. and ViewTrade Securities, Inc. Both companies are wholly owned subsidiaries of ViewTrade Holdings, a privately held developer and provider of technology-advantaged trading platforms and financial products for global institutional markets. The Company expects to use Orbis Systems technology to help enhance the Companys current offerings, develop new technologies, and take advantage of several cross-marketing opportunities, including integrating the Companys IDScreen technology into ViewTrade Securities online trading platform. ViewTrades technology utilizes standardized protocols and strives to incorporate the latest innovations to ensure reliable, swift and secure trading of financial instruments around the globe. Edentify believes that this acquisition will pave the way for some important new initiatives in its commitment to deliver its products to financial service companies worldwide, while building out its capabilities to deliver broader products that are complete from back- to front-end.

Announcement Date: November 29, 2007

Deal Value: Undisclosed

MarketAxess acquires Trade West Systems

MarketAxess Holdings Inc, operator of a leading electronic trading platform for U.S. and European high-grade corporate bonds, emerging markets bonds and other types of fixed-income securities, has acquired substantially all the assets of Trade West Systems, LLC (TWS), a financial software innovator focused on providing gateway adapters for connecting order management systems (OMS) and trading systems to fixed-income trading venues under the 'ProOMS' product name. TWS-branded products acquired by MarketAxess in the transaction also include customizable front-end and middle-tier pricing and trading solutions for the fixed-income and equities markets. Direct connectivity with client OMS systems makes MarketAcess trading solutions more efficient and is a critical driver of secondary trading volumes.

Announcement Date: November 28, 2007

Deal Value: Undisclosed

Fortis Financial Services to acquire Capital Market Solutions

Fortis Financial Services Ltd, (India) which is a substantial stakeholder of Asian CERC Information Technology Ltd., a capital market software provider, has acquired Capital Market Solutions Pvt Ltd. (Australia), a software company providing solutions and services to financial markets in Asia Pacific and UK. With this acquisition, Fortis Financial Services would be capable of backing up ACERC to expand its product reach to the international market.

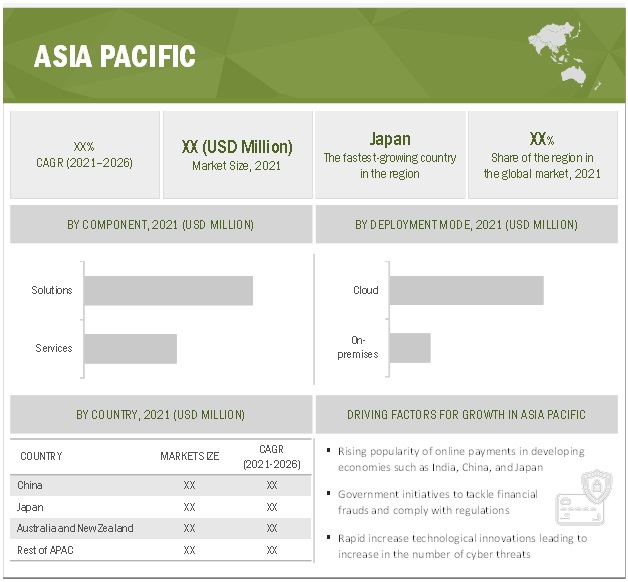

Thales E-transactions Drivers

Announcement Date: November 20, 2007

Deal Value: Undisclosed

SunGard acquires DSPA Software

SunGard has acquired DSPA Software Inc., a supplier of sales compensation and distribution management software to the insurance industry. DSPA Software Inc. offers FASAT, a comprehensive distribution management and incentive compensation management (ICM) software solution for the life insurance industry. DSPA Software Inc. will become part of SunGards insurance business. FASAT adds a comprehensive distribution and ICM software solution to SunGards iWORKS suite of solutions for the insurance industry.

Announcement Date: November 20, 2007

Deal Value: Undisclosed

ING DIRECT acquires ShareBuilder

ING DIRECT USA (part of Netherlands-based ING) acquired ShareBuilder Corporation, a privately held Seattle-based online financial services company. The acquisition, which is part of ING DIRECTs latest step toward meeting the financial needs of Main Street, USA, will add cost-effective, simple investment options to ING DIRECTs consumer product offerings, which currently include online savings and checking accounts, CDs, Mutual Funds and mortgages. With the addition of ShareBuilder ING DIRECT can provide customers a low-cost, easy to understand way to invest on a regular basis. Both Companies share a mission to enable Main Street America to build and manage their wealth in a straightforward manner.

Announcement Date: November 19, 2007

Deal Value: Undisclosed

Capital Markets Technologies acquires majority of iBase Solutions Limited

Capital Markets Technologies has acquired a 55% equity stake in iBase Solutions Limited, a UK-based financial solutions company specializing in optimizing post-trade processes for financial institutions. iBase is set to launch a suite of software products and services designed to replace inefficient and costly manual processes inherent in today's marketplace in Europe but set to change as a result of enforced regulation by the European Commission. iBase will be working closely with London-based Simplex, a company which specializes in providing outsourced payments and post-trade processing services and which CMT has also acquired.

Announcement Date: November 19, 2007

Deal Value: Undisclosed

GL TRADE acquires Decision Software

GL TRADE (France), provider of front-to-back office software solutions for financial institutions, acquired Decision Software, provider of a Fixed Income Trading Platform, connectivity to liquidity provider and web-based B-to-C platform to North American financial institutions. Decision Software, has been active in the financial markets for several years and will significantly strengthen GL TRADE's trading offering. With this acquisition GL TRADE is in a position to create a strong U.S. Front-to-Back solution in Fixed Income as Decision Software will complete GL TRADEs U.S. Capital Market Solutions, which already covers middle and back office and settlement solutions for U.S. Fixed Income.

Announcement Date: November 19, 2007

Deal Value: Undisclosed

Knight Capital Group to acquire EdgeTrade

Knight Capital Group, Inc. is acquiring EdgeTrade Inc., a leading agency-only trade execution and algorithmic software firm. EdgeTrade is a recognized leader in developing algorithmic trading strategies that increase alpha for client firms. As algorithmic trading increases in a fragmented market environment, the acquisition of EdgeTrade will enhance Knights trade execution services and provide it with a significant advantage as demand continues to grow for sophisticated, next generation algorithms. The acquisition of EdgeTrade will strengthen Knight's offering at a time when, according to industry analysts, approximately 94 percent of buy-side firms report they are using equity algorithms, up from 77 percent in 2006.

Announcement Date: November 19, 2007

Deal Value: $59.5 million (cash and stock)

Avalara to acquire New Horizons Systems, LLC

Avalara, a provider of web-hosted sales tax management services, is acquiring New Horizons Systems, LLC, a supplier of business geographic and tax jurisdiction assignment software products and data files. By acquiring New Horizons Systems, LLC, Avalara expects to accelerate delivery of next generation services while enhancing its position as the industrys premier accurate sales tax management service provider. Specializing in special tax district geometry, New Horizons Systems is one of only two data providers for geographic tax determination in the United States. Once the acquisition is finalized, Avalara will be the only provider in North America of end-to-end sales tax management services with this level of geographic information system (GIS) mapping technology.

Announcement Date: November 14, 2007

Deal Value: Undisclosed

DIFC Investments to acquire SmartStream Technologies

DIFC Investments, the investment arm of the Dubai International Financial Centre (DIFC) is acquiring SmartStream Technologies, the UK-based software licensing and professional services business from TA Associates, SmartStream management and employees. This acquisition enhances the DIFCs role in the global financial services industry and further establishes the DIFC as a global gateway for international financial business. DIFC Investments aims to create a new generation of hosted information and trade processing services, and its intention is that SmartStream will be at the heart of the secure, scaleable trade processing and data management platform it is building.

Announcement Date: November 12, 2007

Deal Value: $410.8 million

TheStreet.com acquires Bankers Financial Products Corp.

TheStreet.com, Inc., a provider of financial news and ratings, business and investment content and custom advertising solutions, acquired Bankers Financial Products Corp., including BankingMyWay and RateWatch. RateWatch is one of the nations largest providers of pricing solutions for banks and credit unions. The Company was established in 1999, and has more than 5,700 financial institutions subscribing to its services. BankingMyWay.com, leveraging the rich data set of RateWatch, allows consumers to conduct free searches to find the best banking rates within their city, zip code or state. Rates include CDs, savings accounts, interest checking, money markets, mortgage/home equity and auto loans. BankingMyWay provides rates from more than 50,000 bank and credit union locations, allowing consumers to find the best rates. This is an accretive content acquisition that will help propel TheStreet.com into a leading position in the Internet consumer banking marketplace.

Announcement Date: November 2, 2007

Deal Value: $25 million

Purepay acquires Netvantage

Purepay, a $100 million buyout fund focused on payments, banking and the financial supply chain, has acquired Netvantage, a remittance processing software provider focused in the middle market commercial customer. Netvantage serves over 140 customers with an emphasis on state and local government. In addition to government entities, the companys payment processing software is used by the utility, insurance, publishing and non-profit industries. The acquisition strengthens Purepays footprint in payment processing, coming on the heels of the firms acquisition of Creditron, another leader in the mid-market remittance space. With five million capture points to be won, Purepay believes that the small-to-medium enterprise remittance category is a promising investment environment. These two acquisitions, combined with Jack Henrys recently announced purchase of AudioTel, signal the beginning of an industry consolidation of the SME remittance category.

Announcement Date: November 1, 2007

Deal Value: Undisclosed

Fiserv acquires BancIntelligence

Fiserv, Inc. has acquired BancIntelligence, the only online advisory solution for financial institutions, providing automated analysis and web-based strategy development to more than 500 clients headquartered in 49 states. BancIntelligence provides banks of all sizes continuous online access to bank financial and market analysis. Integrating BancIntelligence capabilities into Fiservs solution set will further differentiate Fiserv in the competitive landscape.

Announcement Date: October 15, 2007

Deal Value: Undisclosed

Computershare to acquire Restricted Stock Systems

Computershare Limited, a financial services provider for the global securities industry, is acquiring Restricted Stock Systems, Inc., a provider of insider trading software and services to brokerage firms and publicly traded companies. Restricted Stock Systems' solutions allow inside traders to buy or sell securities within the trading plan safe harbor of SEC Rule 10b5- 1(c). Trading plans can be selected, approved, monitored and sent directly to a preferred broker entirely through the RSS web-based application. The acquisition will enhance Computershare's growing number of compliance-related services, including stock option, restricted and employee stock purchase plan administration and software as well as global subsidiary management solutions. The RSS solution will also complement and enhance Computershare's current employee plans offering in the U.S.

Announcement Date: October 11, 2007

Deal Value: Undisclosed

ICAP to acquire Traiana

ICAP PLC is acquiring Traiana Inc, a developer of post-trade processing software. Traiana provides global banks, broker/dealers, buy-side firms and e-trading platforms with solutions to automate post-trade processing of financial transactions. Its Harmony network is used by over 50 of the world's leading banks and has become the market standard for post-trade processing of FX transactions. Traiana's technology is used to process tens of thousands of deal tickets every day and contributes to the orderly growth of the global financial markets. To date Traiana has invested $90 million to achieve critical mass in its markets. Traiana's business model is driven by the growth in the number of trades as each trade triggers multiple post trade events and Traiana charges for each event. Traiana has shown very significant growth and ICAP believes this growth can be accelerated much further.

Announcement Date: October 11, 2007

Deal Value: $247 million (Cash and stock)

i-flex Solutions acquires Castek

i-flex solutions (majority owned by Oracle), an IT solutions provider to the global financial services industry, acquired Castek Software Inc., provider of core insurance-business processing systems for large- and mid-sized Property and Casualty (P&C) insurers. Castek's product is proven and is being used by two large North American customers. With i-flex's wide market reach, the potential to expand is now much greater.

Announcement Date: October 4, 2007

Deal Value: Undisclosed

AllRegs acquires Lender E-Source

AllRegs, information provider for the mortgage lending industry, acquired Lender E-Source, a web-based purveyor of mortgage lending product and underwriting guidelines. This acquisition vastly increases the AllRegs product suite as well as the organizations library of content and investor product guidelines. Lender E-Source provides web-based solutions that allow lenders to manage the wide variety of constantly changing loan product and underwriting guidelines through a searchable, automatically managed loan guideline library.

Announcement Date: October 4, 2007

Deal Value: Undisclosed

Thales E-transactions Driver Updater

ProfitStars acquires AudioTel Corporation

ProfitStars (a division of Jack Henry & Associates, Inc) which provides highly specialized products and services that enable financial institutions to mitigate risks, optimize revenue, and contain costs, today acquired AudioTel Corporation. AudioTel supports more than 1,000 financial institutions with back-office and retail banking solutions. AudioTel provides proven remittance, merchant capture, check imaging, document imaging and management, and telephone and Internet banking solutions. The acquisition of AudioTel supports ProfitStars strategy to acquire companies that provide additional complementary solutions it can cross sell to its core financial institution clients, that generate new cross-sale opportunities among respective client bases.

Announcement Date: October 2, 2007

Deal Value: Undisclosed

First American acquires Proxix Solutions

Thales E-transactions Driver Ed

Business information company First American Corp. acquired Proxix Solutions, which provides location information services to businesses. First American said the acquisition enables the company to deliver a broader range of services for insurance, financial services and the public sector, as well as other emerging markets. Proxix will be integrated into the newly formed First American Spatial Solutions division based in Austin, Texas. FASS is part of the company's mortgage information services group. First American said Proxix will expand the company's expertise in geospatial technologies, including geocoding and spatial analytics.

Announcement Date: October 1, 2007

Deal Value: Undisclosed

Hypercom to acquire Thales SA eTransaction Business